The XFL filed for Chapter 11 bankruptcy on Monday, according to documents obtained by The Action Network.

The league fired all of its employees without severance on Friday after having to cancel the remainder of its inaugural season due to the coronavirus.

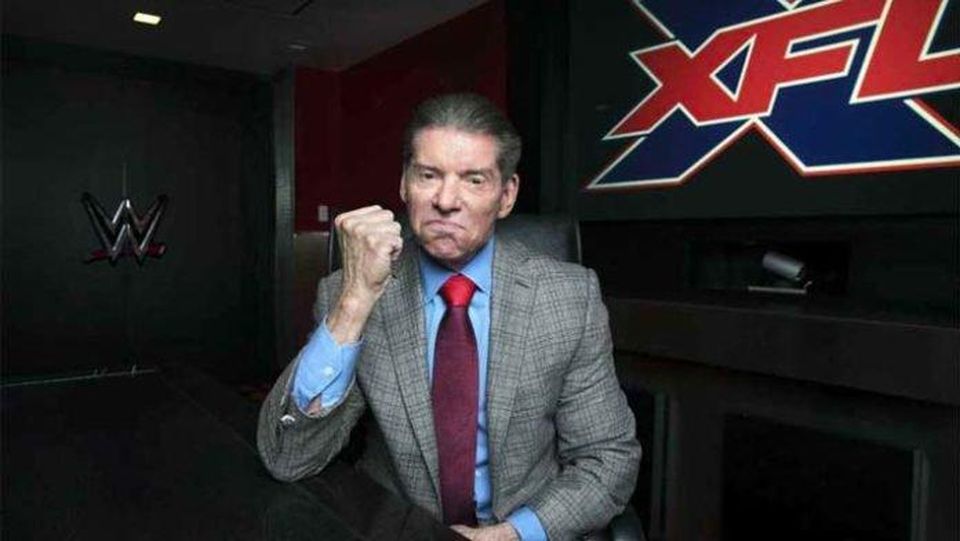

Sources said that Vince McMahon, owner of the XFL and chairman/CEO of the WWE, informed the WWE board he was going to pull the plug on the XFL. An original version of this story indicated that McMahon had done so after consulting with the board.

In response, the WWE’s attorney Jerry McDevitt says, “The WWE board has no role in the XFL, and there was no conversation that happened.”

Creditors mentioned in the filing include the XFL’s first batch of head coaches — the Dallas Renegades’ Bob Stoops ($1.083 million), the Tampa Bay Vipers’ Marc Trestman ($777,777), the St. Louis BattleHawks’ Jonathan Hayes ($633,333) and others ($583,333 each) — and the owners of stadium leases, including the St. Louis Sports Commission, which is the XFL’s No. 1 creditor ($1.6 million owed), and the New Meadowlands Stadium Company, owners of MetLife Stadium ($368,000).

Other creditors include the official hat partner 47 Brand ($846,000), the league’s ticket partner Ticketmaster ($655,148), and BigGame USA ($217,000), the company that made the league’s ball.

The XFL got off to a hot start from a viewership perspective, drawing 3.12 million viewers in Week 1. By the time Week 5 rolled around, that number had been cut in half. Still, there were signs of life. The St. Louis BattleHawks had reportedly sold 45,000 tickets to their next game before the league shut down due to the coronavirus outbreak.

McMahon funded the XFL through a company called Alpha Entertainment. He had publicly pledged to back his second attempt at an upstart football league with his own cash, upwards of $500 million.

Monday’s filing noted the amount of Class B shares (23.5%) the WWE owned of Alpha Entertainment.

McMahon’s double-duty as owner of the XFL and leader of the WWE had been questioned by Wall Street analysts. The WWE’s share price dropped 28% in the two weeks before the XFL’s launch on Feb. 8.

Two days prior, on a WWE earnings call, analysts from JP Morgan and Citigroup pressed McMahon on the connection between the XFL and the WWE. In response, McMahon said the XFL was “completely separate” from the WWE, adding later, “We have like 400 employees over there. It’s run by itself and there is no investment whatsoever hardly in, you know, WWE.”

The Action Network initially reported that it did not find any disclosure of a direct connection between the XFL and the WWE, but a WWE spokesman pointed to SEC filings in 2018 and 2019, which disclosed WWE receiving an equity share in Alpha Entertainment, in exchange for the XFL name and shared services.

McDevitt insisted in an interview with The Action Network that WWE’s partial ownership of the XFL does not mean the two entities do not operate independently.

Alpha Entertainment’s offices were a stone’s throw from the WWE’s headquarters in Stamford, Conn. and sources tell The Action Network that there was frequent traffic between the two buildings. It was known among both companies that certain employees were “essentially working two full-time jobs,” according to a source, one for the wrestling organization and one for the football league.

Eighteen months ago, McMahon was worth $3.3 billion, according to Forbes. He’s worth roughly half of that now — $1.9 billion, according to the magazine.